Exploring Opportunities in Abandoned Properties

Understanding the Appeal of Abandoned Houses for Sale

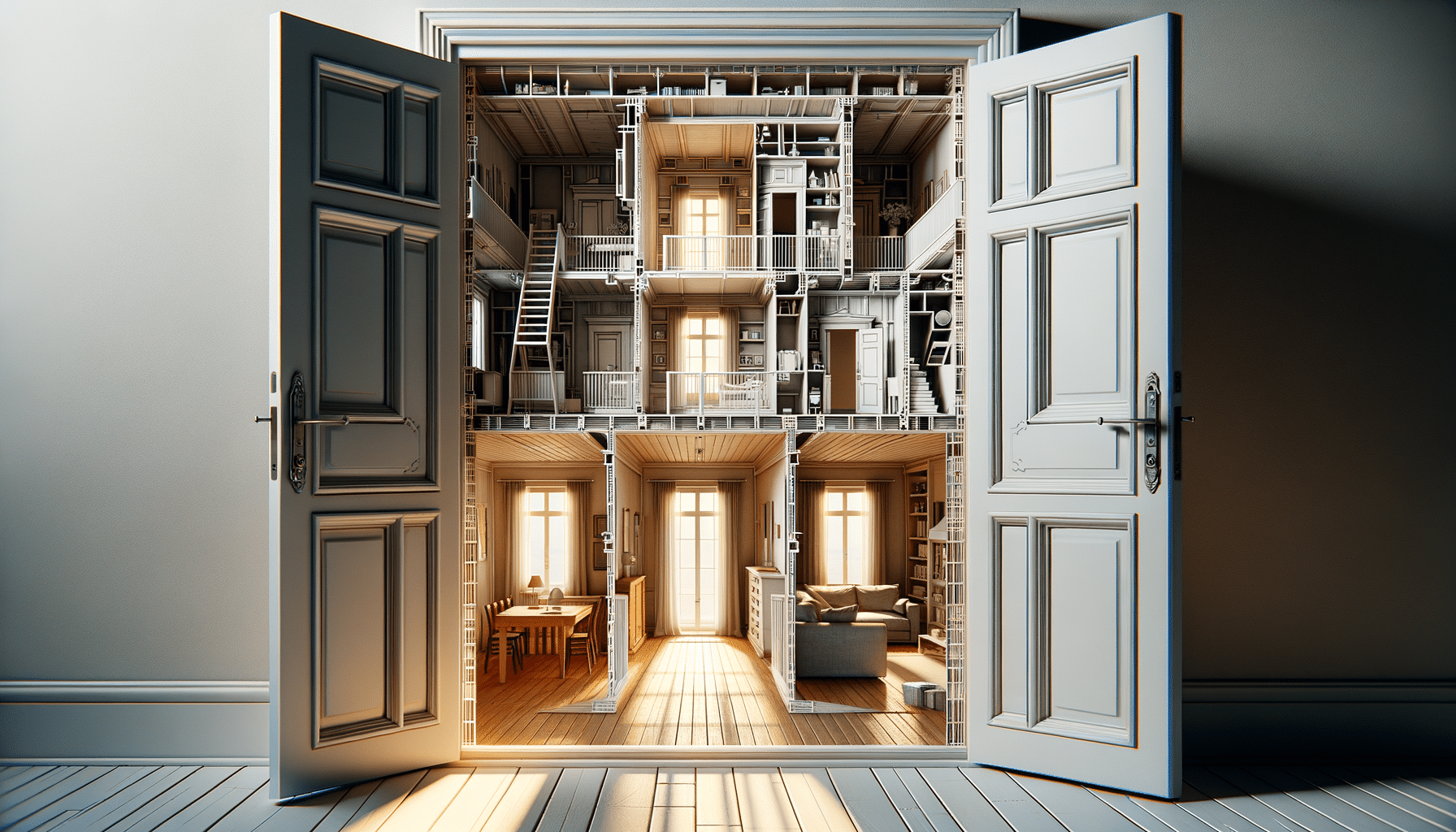

Abandoned houses often carry an air of mystery and potential. For many, the idea of acquiring such properties can be both intriguing and daunting. These houses, left untouched over the years, can be found in various locations, from bustling cities to quiet rural areas. The reasons for abandonment are numerous, ranging from financial difficulties to changes in personal circumstances. As a result, these properties often come at a significantly reduced price, making them an attractive option for budget-conscious buyers and investors.

One of the main appeals of abandoned houses is their potential for transformation. With the right vision and investment, these properties can be transformed into beautiful homes, rental properties, or even commercial spaces. This potential for renovation and value addition is what draws many investors to consider abandoned houses as viable investment options.

However, purchasing an abandoned house is not without its challenges. Prospective buyers must be prepared to conduct thorough inspections and assessments to understand the extent of repairs needed. Additionally, navigating legal and bureaucratic hurdles, such as clearing any liens or back taxes, is crucial to ensure a smooth transaction. Despite these challenges, the allure of turning a forgotten property into a valuable asset continues to captivate real estate enthusiasts.

Investing in Abandoned Properties: A Strategic Approach

Investing in abandoned properties requires a strategic approach, combining careful research with a clear understanding of market dynamics. The first step in this process is identifying properties that have the potential for appreciation. This involves evaluating the location, assessing the surrounding neighborhood, and understanding local real estate trends. Properties in areas with rising demand or planned infrastructure developments are often considered promising investments.

Another critical aspect of investing in abandoned properties is budgeting for renovations. Investors must account for the cost of repairs and improvements, which can vary widely depending on the property’s condition. Creating a detailed renovation plan and working with experienced contractors can help manage these costs effectively. Additionally, investors should be prepared for unexpected expenses, which are common in renovation projects.

Financing is another key consideration. While abandoned properties may be cheaper to purchase, securing financing for renovations can be challenging. Investors should explore various financing options, such as renovation loans or partnerships with other investors. By taking a strategic approach and considering all aspects of the investment, buyers can unlock the potential of abandoned properties and achieve significant returns.

Creative Uses for Abandoned Properties

Beyond traditional residential or commercial uses, abandoned properties offer opportunities for creative and innovative projects. Many investors and developers have explored unconventional uses for these spaces, transforming them into unique venues or community hubs. For example, some have converted abandoned factories into art galleries or event spaces, capitalizing on the industrial aesthetic and spacious interiors.

Another popular trend is the conversion of abandoned houses into co-working spaces or boutique hotels. These creative transformations not only breathe new life into the properties but also contribute to the revitalization of the surrounding areas. By repurposing abandoned spaces, investors can tap into niche markets and attract diverse clientele.

Community involvement is also a crucial aspect of repurposing abandoned properties. Collaborating with local organizations and residents can lead to projects that benefit the community, such as affordable housing initiatives or cultural centers. This collaborative approach not only enhances the property’s value but also fosters a sense of community ownership and pride.