Understanding the Dynamics of Stock Markets: Applications, Analysis, and Trends

Introduction to Stock Market Applications

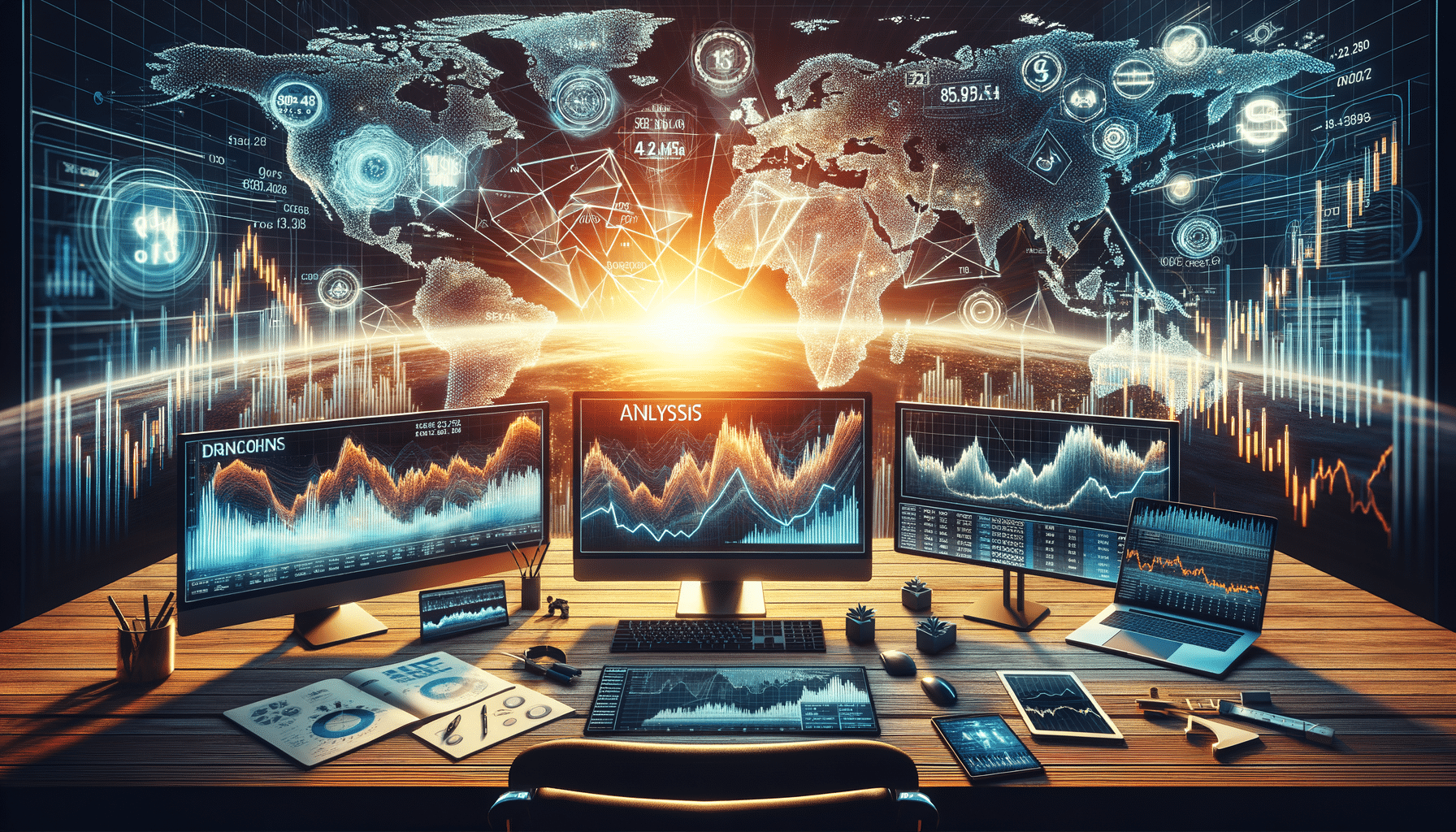

The stock market is a complex ecosystem where investors, companies, and regulators interact to facilitate the buying and selling of shares. Stock market applications have emerged as essential tools for both novice and seasoned investors, providing a platform to execute trades, access real-time data, and analyze market trends. These applications are designed to offer user-friendly interfaces that simplify the investment process, making it accessible to a broader audience.

Stock market applications play a crucial role in democratizing finance by offering features such as:

- Real-time stock quotes and news updates

- Portfolio management tools

- Technical and fundamental analysis tools

- Customizable alerts and notifications

These features empower users to make informed decisions, contributing to a more transparent and efficient market. The integration of artificial intelligence and machine learning into these applications further enhances their capabilities, offering predictive analytics and personalized investment advice.

Stock Market Analysis Techniques

Stock market analysis is a critical aspect of investing, providing insights into the potential performance of stocks. Investors rely on two primary methods: fundamental analysis and technical analysis. Fundamental analysis involves evaluating a company’s financial statements, management, industry position, and economic factors to determine its intrinsic value. This approach is favored by long-term investors looking to invest in undervalued stocks.

On the other hand, technical analysis focuses on historical price movements and trading volumes to predict future price trends. Technical analysts use charts and indicators to identify patterns and make short-term trading decisions. Common tools include moving averages, relative strength index (RSI), and candlestick patterns.

Both methods have their strengths and limitations, and many investors use a combination of the two to maximize their investment strategies. The choice of analysis technique often depends on the investor’s goals, risk tolerance, and investment horizon.

Identifying Stock Market Trends

Understanding stock market trends is essential for investors aiming to capitalize on market movements. Trends can be categorized into three types: uptrends, downtrends, and sideways trends. An uptrend is characterized by rising stock prices, indicating a bullish market sentiment. Conversely, a downtrend signifies declining prices and bearish sentiment. Sideways trends occur when prices fluctuate within a narrow range, indicating market indecision.

Investors often use trend analysis to identify potential entry and exit points. Key indicators include moving averages, trendlines, and the MACD (Moving Average Convergence Divergence) indicator. Recognizing trends early can provide a competitive advantage, allowing investors to align their strategies with market dynamics.

Market trends are influenced by various factors, including economic indicators, geopolitical events, and investor sentiment. Staying informed about these factors is crucial for adapting to changing market conditions.

The Role of Technology in Stock Market Evolution

Technology has revolutionized the stock market, making it more accessible and efficient. The advent of online trading platforms and mobile applications has lowered the barriers to entry, enabling more individuals to participate in the market. High-frequency trading (HFT) and algorithmic trading have also transformed the landscape, allowing for faster and more precise execution of trades.

Moreover, the use of big data and analytics has enhanced the ability to process vast amounts of information, providing deeper insights into market behavior. Artificial intelligence and machine learning are increasingly being used to develop sophisticated trading algorithms and predictive models.

As technology continues to advance, the stock market is likely to become even more integrated with digital innovations, offering new opportunities and challenges for investors.

Conclusion: Navigating the Stock Market with Confidence

The stock market is a dynamic and ever-evolving arena that offers significant opportunities for wealth creation. By leveraging stock market applications, conducting thorough analysis, and staying attuned to market trends, investors can navigate this complex environment with greater confidence. While the market presents risks, informed decision-making and strategic planning can help mitigate these risks and enhance investment outcomes.

As the market continues to evolve, staying informed and adaptable will be key to success. Whether you are a novice or an experienced investor, understanding the intricacies of the stock market can empower you to make more informed investment decisions.